Dear Luxury – it’s been a cracker of a year – but before we sign off, we thought we’d gift you with a recap of what has made 2015 revolutionary. Enjoy and see you all in 2016 for more food for thought.

We all know it’s been a transformative year for the luxury sector, but pinpointing what has made it so amongst the smorgasbord of information we now all have access to these days, can be a bit harder.

So without further ado – here is our take on the trends in 2015 that have changed the luxury sphere forever.

“ It’s been a transformative year for the luxury sector ”

1. Chinese Luxury Consumers

This one has been blatantly obvious for some time now, so shouldn’t come as a surprise. As Luxury Society reported earlier this year, Chinese are currently the #1 consumers of luxury globally.

As confirmed by the 14th edition of its Luxury Goods Worldwide Market Monitor by Bain & Company, the global luxury market surpassed €1 trillion in retail sales value in 2015, with Chinese consumers making up the largest portion of luxury purchases globally (31%).

According to the ‘China Luxury Report 2015’ report released in November 2015, by Shanghai-based consultants Fortune Character Institute, this trend is set to continue – with Chinese shoppers forecast to spend US$117 billion, or 9% more, on luxury goods than in 2015.

“ A raft of luxury brands have lately been executing targeted campaigns to capture the Chinese consumer ”

In response, a raft of luxury brands have lately been executing targeted campaigns to capture the Chinese consumer – such as US jeweller Tiffany & Co., which launched a dedicated video campaign in October 2015 promoting its key motif, with videos in Chinese without subtitles, and posted to Chinese Web sites rather than YouTube.

Debuting in November, luxury lifestyle magazine Galerié is also working to capture the attention and shopping funds of wealthy Chinese tourists returning to the US for business and leisure.

The later also hints towards another trend making its way from this year into next.

Interestingly, the China Luxury Report 2015 also found that 78% of the purchases by Chinese consumers are set to be made overseas, with just 10% of worldwide sales expected to be in China, down from 11% in 2014.

It should be noted that the report looked at sales of jewellery, watches, accessories and clothes, but not cars, yachts, jets or art – however, the impact of this shift in the making is already coming to a head, with some luxury giants already moving out of the region.

Institute director Zhou Ting said one top watch brand failed to sell a single timepiece in the past year, but she refused to name the company.

“ More than 80% of global luxury brands had closed mainland stores in China ”

In addition, she said that more than 80% of global luxury brands had closed mainland stores in China and conditions are set to worsen.

A case in point – as reported by Bloomberg in November, Louis Vuitton, has been reviewing eight stores in second-tier cities, or about a fifth of the total in China, and has already closed three stores on the mainland, including its first one in Guangzhou.

Closures by other luxury-goods makers may follow, according to Exane analyst Luca Solca. Kering SA-owned Gucci and Burberry, both of which have also struggled in China, have more stores there than Vuitton, according to Exane. Chinese consumers account for about a third of global luxury sales. Gucci has 57 stores in China, while Burberry has 55.

“ 50% of China’s domestic luxury consumption expected to be generated online by 2020 ”

However – that’s not to say that there isn’t still money to be made in China.

Online confidence is booming for this lucrative set, according to a recent report published by KPMG covering ‘China’s Connected Consumers.’ The 2015 study, released last month, revealed 45% of luxury online shoppers now buy over half of their luxury goods online, with 50% of China’s domestic luxury consumption expected to be generated online by 2020.

Tips on how to leverage the trends sweeping this lucrative consumer set and devise digital strategies to entice Chinese consumers to luxury were showcased at this month’s Digital Luxury Keynote conference in Shanghai, with Luxury Society’s parent company Digital Luxury Group revealing insights into the Chinese consumer mindset – direct from its experts at its newly established Shanghai office.

2. Internet & Mobile Devices

As Luxury Society highlighted from outtakes of the the latest McKinsey/Altagamma Digital Luxury Experience Report 2015, the rise and accessibility of the internet and smartphones across all continents now, has made e-commerce and the use of digital channels a must for all businesses and brands.

A recent study on ‘Luxury shopping in the digital age’ of more than 3,000 luxury customers in six major luxury markets by McKinsey also found that three out of four luxury shoppers now own a smartphone and about half own a tablet.

To put this further into perspective – 75% of all luxury sales today are influenced by digital, according to the aforementioned Luxury Experience Report 2015 report.

“ Luxury sales realised online are expected to rise to 18% in 2025 to reach €70 bn of a total €390 bn ”

This could go up to 100% by 2025, so luxury brands have no choice but to embrace the digital era and become truly omni-channel.

Additionally, according to the figures, luxury sales realised online have accelerated in 2014 reaching €14 bn of a total €224 bn – a 50% rise from 2013. They now represent 6% of the global luxury market for personal goods.

That figure is expected to rise to 18% in 2025 to reach €70 bn of a total €390 bn.

“ Luxury brands at the forefront of this trend have already made moves in leaps & bounds to capitalise ”

Last year, nearly all of the €5 bn in luxury goods market growth came from e-commerce.

Luxury brands at the forefront of this trend in 2015 have already made moves in leaps and bounds to capitalise on this mega-movement, with Net-A-Porter a testament to the success and potential for luxury promoted and sold online.

UK luxury leader Burberry is another classic case in point.

Known worldwide for its digital prowess, the brand boomed onto the scene in 2009 with the launch of “Art of the Trench,” a microsite that runs user-generated content of people wearing Burberry’s signature trench coat.

The luxury behemoth expanded its reach in 2010 during its Spring/Summer fashion show that year, when it live streamed the event, giving anyone access to the traditionally exclusive runway action.

Burberry then moved to capitalize on those watching its every move on the runway — and in 2013, produced a made-to-order catwalk service, which sold runway pieces directly from the Spring/Summer 2014 collection online and on mobile immediately after the show ended, for a two-week period.

“ The world’s luxury consumers are now internet-equipped and mobile in every sense of the word ”

Needless to say, these initiatives have been a success, and Burberry remains at the top of its game – so, enough said.

The world’s luxury consumers are now internet-equipped and mobile in every sense of the word – and most people in even the most far flung countries now have access to the internet via smartphones, which are becoming more affordable by the minute.

The rest ain’t rocket science – e-commerce and omni-channel operations are the future. If you haven’t yet – it’s time to get cracking on that if you plan to survive and prosper.

“ When it comes to social networks, however, luxury shoppers use them mostly to do research or retweet posts ”

3. Social Media

Another no-brainer. But just for kicks – here it all is in a nutshell.

Luxury shoppers today are avid social media users. A study by McKinsey on ‘Luxury shopping in the digital age’ of more than 3,000 luxury customers in six major luxury markets recently brought this to the fore.

When it comes to social networks, however, the report found that luxury shoppers use them mostly to do research or retweet other people’s posts, not so much to post their own comments.

Thirty percent of the luxury shoppers in McKinsey’s study sample had commented on luxury products via social media, with cars crowned the luxury category with by far the most social-media buzz – mentioned in about 2,000 tweets per day – followed by luxury ready-to-wear apparel, and then fashion accessories.

Snapchat is arguably the newest platform in Western markets to make a splash with luxury brands and consumers – with Givenchy, Gucci, Hublot, Louis Vuitton – and even luxury publishing conglomerate Conde Nast recently jumping on the Snapchat bandwagon to take advantage of its rising popularity – particularly with the lucrative Millennials set.

Once again, Burberry is also at the forefront of this trend.

“ More recently, Burberry joined forces with famous fashion photographer Mario Testino for a Snapchat initiative ”

During the Spring/Summer 2016 fashion show, the brand went beyond live streaming (see above), and shared shots of the entire collection on Snapchat before it premiered on the runway, to the tune of 100 million impressions.

More recently, in October 2015, Burberry joined forces with famous fashion photographer Mario Testino recoding the production of its spring 2016 ad campaign for the ephemeral social network.

Burberry tapped Testino to shoot images and video of the making of the campaign in London Thursday to create an exclusive campaign for Snapchat followers, with Testino publishling content in real time to the brand’s Snapchat account starting at noon and the images and videos will disappear after 24 hours.

Burberry/Mario Testino Snapchat initiative

In China, Burberry has also tested instant orders via text message on WeChat.

It’s impossible to ay how man luxury shoppers and possible luxury consumers there are on different social media platforms across the globe, but it’s for to say that most who are on social channels react well to digital campaigns.

This is part of a larger social and psychological shift – being led by the Millennial set – whereby brands do not hold the power anymore – the buyers do. Therefore, connecting with them via social channels, whilst also leveraging their icons and influencers (see more about that here: http://luxurysociety.com/articles/2015/10/how-luxury-brands-are-leveraging-the-new-influencers) will inevitably lead to more positive results in terms of both brand engagement and bottom line sales.

“ As for the most visible brands on social media, Chanel takes the cake ”

As Forbes magazine reported earlier this year, only 1% of Millennials surveyed said that a compelling advertisement would make them trust a brand more, while 33% rely mostly on blogs before they make a purchase, compared to fewer than 3% for TV news, magazines and books.

I rest my case.

If you want to know who’s doing social media better than the rest on the luxury sphere – social media consultancy Brandwatch recently published a report which analysed 32 luxury fashion brand, parsing through 721,140 social conversations, looking at five categories: social visibility, general visibility, net sentiment, reach growth, and social engagement and content. It found that luxury fashion brands tweet and post on Facebook less than two times on each platform in an average day, compared to the roughly 27 tweets per day that leading food and beverage brands churn out (though businesses in this category also post fewer than two times daily on Facebook).

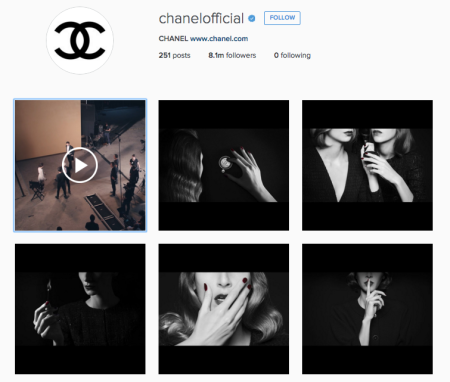

“ Luxury Society worked with DLG earlier this year to nut out the Top 10 Most Popular Luxury Brands On Instagram ”

As for the most visible brands on social media, Chanel takes the cake, followed by Dior, Calvin Klein, Louis Vuitton, Ralph Lauren, Tiffany & Co., Burberry, and Gucci. The five least visible brands are Hermes, Salvatore Ferragamo, Kenzo, Dsquared, and DKNY, consecutively.

The three highest scoring labels (in all five categories above), are Calvin Klein, Christian Dior, and Louis Vuitton. Also, Chloé is apparently the fashion house that has women talking the most on social media (a.k.a. “leading the conversation,” according to Brandwatch).

Tiffany & Co., Christian Louboutin, and Michael Kors topped the list in terms of most-responsive brands.

Looking at Instagram specifically – which is arguably the most effective platform for luxury brands overall due to its focus on stunning and inspirational visuals – Luxury Society worked with Digital Luxury Group (DLG) earlier this year to nut out the Top 10 Most Popular Luxury Brands On Instagram.

Oh – and we also analysed why they became so popular and how luxury brands wanting to replicate their success can leverage the platform best.

You’re welcome.

“ Knowing how to optimise SEO & sites to make luxury products easier to find, is absolutely ESSENTIAL ”

4. Search

So, given points 2 and 3 – it goes without saying that search and knowing how to optimise SEO and internet sites to make luxury products easier for your shoppers to find, is absolutely ESSENTIAL.

The McKinsey on ‘Luxury shopping in the digital age’ revealed that while luxury consumers are at at work they rely mostly on desktop or laptop computers, but while commuting, dining, or shopping, they’re more likely to use smartphones, especially to search for products and store locations.

Hence, more than half of luxury shoppers’ searches are mobile, and more than one in five of the shoppers in the company’s sample said they often or always do some research on a mobile device before making a luxury purchase.

“ DLG recently collaborated with Baidu to investigate 2015’s China Luxury Trends and the impact of search ”

Focusing on the all important Chinese market, the Shanghai office of Digital Luxury Group recently presented excerpts from a soon-to-be released report, in collaboration with Baidu, on 2015’s China Luxury Trends and the impact of search in the region.

The report, to be released next month via Luxury Society, incorporates results from 18 months of data (January 2014 to June 2015) and more than one billion spontaneous searches queries, analysed across four segments (Watches, Ready-To-Wear, Jewelry, Bags), and including over 80 brands.

Exclusive data and indicators include search volumes, click-through-rate, mobile share, and breakdown by keyword, as well as rising trends in the areas of gifting trends and seasonality, influencers and Key Opinion Leaders (KOLs).

Setting the scene, the duo revealed the number of ‘netizens’ in China has grown from 137,0 to 667,7 million from 2006 to 2015, with almost 90% using mobile for search over desktop.

Luxury industry search volumes are growing steadily at double-digits, with watches still reigning as the most popular segment in overall, and fashion searches “no longer limited to accessories (handbags) anymore.

Fashion in particular has experienced a stronger seasonality, with 560k searches daily for

ready-to-wear (RTW), with peaks of interest at the beginning of summer and winter, and a growth of 38%, with 57% via mobile.

“ Louis Vuitton is one luxury brand taking advantage of users’ appetite for pictures during the search journey ”

Non-brand keywords take up more than half of the RTW category (57%), with Baidu Picture (52%) and Encyclopedia (23%), the most popular platforms, besides search engines, indicating the visual and educational needs required by users.

Louis Vuitton was showcased as a luxury brand taking advantage of users’ appetite for pictures during the search journey.

The report also revealed that fashion users are also seeking more inspiration and lifestyle content, with searches for ‘Mix & Match’, ‘StreetShoot’, and ‘Fashion Weeks’, high on the list.

“ KOLs & designers are playing an increasingly important role in the consumer search and purchase journey in China ”

Highlighting the opportunity for luxury brands to leverage these emerging trends, both Pablo Mauron, General Manager China, Digital Luxury Group, and Charly Cai Zhiyuan, Director of Luxury Industry, Baidu added that KOLs and designers are playing an increasingly important role in the consumer search and purchase journey in China.

Celebrity fashion is a rising trend, as are KOLs, with their reach extending far beyond their owned channels, and Korean influencers in particular impacting increasingly on Chinese culture.

Western influences are also changing the way Chinese culture responds to gift giving occasions, with the highest number of gift season searches surprisingly identified by DLG and Baidu as: Father’s Day with 340K/day, followed by Valentine’s Day with 240K/day, and then Christmas (70K/day).

5. Travel Retail

Today’s consumers – as we have said, are now mobile in every sense – and that means physically too.

Travel and experiences are, ultimately, the newest and most exhilarating for of luxury in this day and age, and consumers of all ages, backgrounds, incomes and interests are jetting off around the world faster than luxury brands can keep up.

Or can they? Enter travel retail and experience-based luxury – allowing luxury brands to capture the consumer on the move.

“ Luxury brands are increasingly establishing themselves in airports and other hot tourism destinations ”

This trend has seen luxury brands increasingly establishing themselves in airports and other hot tourism destinations, and even investing in temporary pop-up shops to take advantage of seasonal influxes of affluent consumers.

That’s a wrap folks. we hope you’ve enjoyed our content so far, and see you all in 2016 for more food for thought.

Happy holidays!